The world of equity derivatives is often shrouded in complexity and uncertainty. Recently, we delved into SEBI’s analysis of profits and losses in the equity derivatives segment from FY22 to FY24. What we discovered was both eye-opening and thought-provoking. The data reveals not only the intricacies of derivatives trading but also the harsh financial realities faced by traders over the past two years.

In this blog, we aim to dissect the findings of the analysis, offering insights into trader demographics, performance trends, and the broader implications of these numbers.

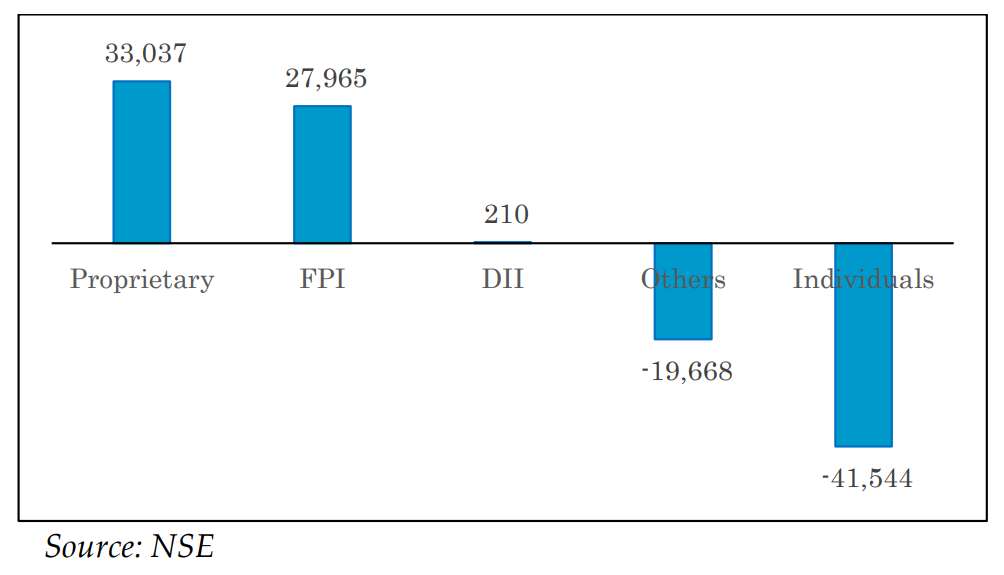

At First Lets look the category of traders whcih traded. Below is the data for FY 24 the Individual category Traders experienced the highest gross loss of ~ ₹41,500 crore,

Category-wise Profit & Loss for FY24

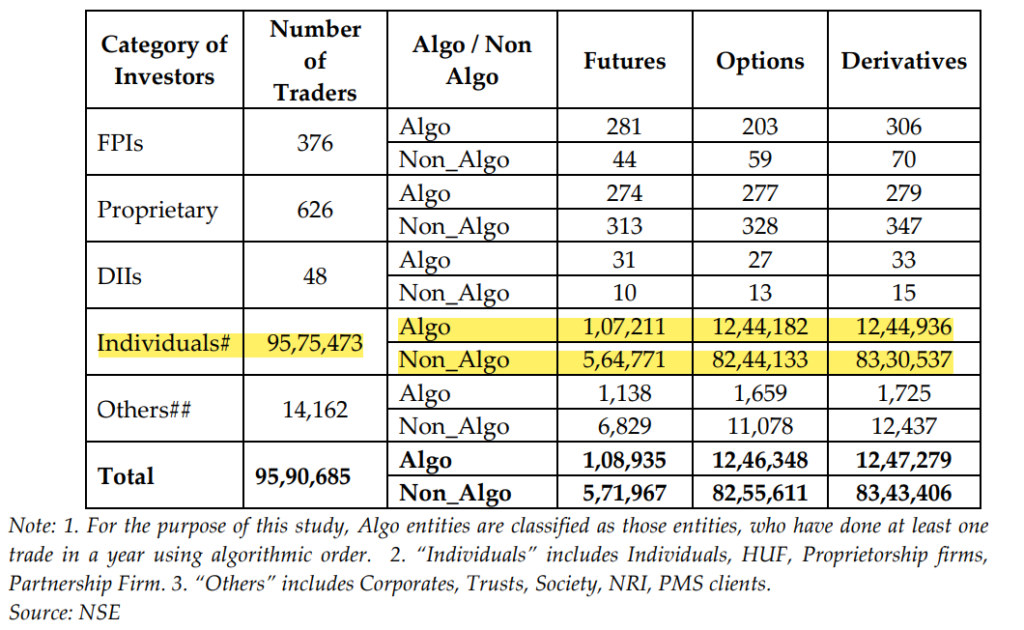

Trading Landscape

A significant portion of profits in Futures and Options (F&O) has been captured by algorithmic trading entities. According to the analysis, foreign portfolio investors (FPIs) and proprietary traders largely relied on algorithms, showcasing the growing influence of technology in trading practices.

The Loss Makers

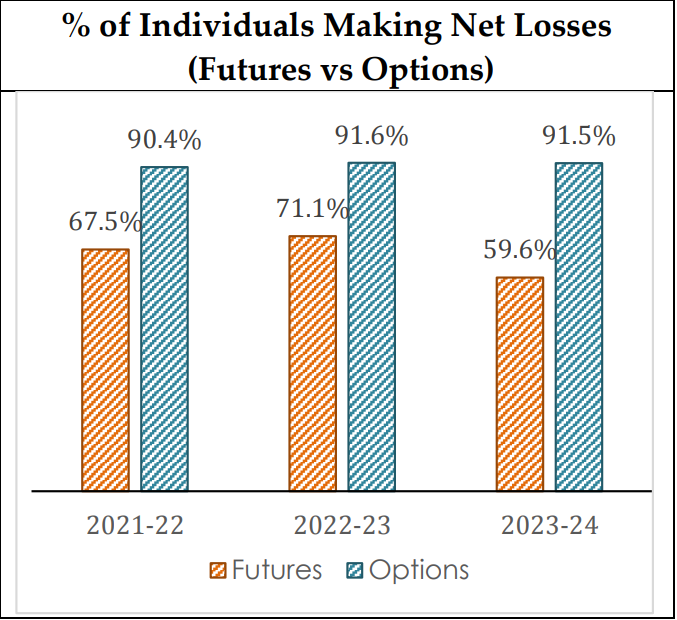

The data indicates that of the 113.2 lakh individual F&O traders, a staggering 91.3% (103.4 lakh traders) engaged solely in Options trading, while only 0.6% (0.70 lakh traders) focused exclusively on Futures. This highlights a clear preference among traders for Options, yet raises questions about the overall profitability within this segment.

In FY24, 91.1% individuals made net losses (i.e. trading losses inclusive of transaction

costs) in F&O, compared to 91.5% in FY23 and 90.2% in FY22. In terms of gross P&L

(i.e. trading profits & losses before accounting for transaction costs), 85.1% of

individuals made losses in FY24.

Age-wise Trends

Interestingly, the proportion of young traders—those under 30 years—has surged from 31% in FY23 to 43% in FY24. However, the analysis also reveals a concerning trend: younger traders tend to incur losses more frequently.

In FY24, 93% of traders under 30 recorded losses, whereas only 79% of traders over 60 experienced similar setbacks. This suggests that as traders gain experience and maturity, they may adopt more prudent risk management strategies.

Income-wise Trends

The analysis also examined the financial profiles of individual F&O traders. Nearly 76% declared annual incomes of less than ₹5 lakh, while around 94% reported incomes below ₹10 lakh. This indicates that small and mid-income traders (those earning less than ₹10 lakh) constitute almost 98% of the trader population, painting a picture of a largely undercapitalized trading environment.

New Traders vs. Regular Traders

A staggering 42 lakh traders entered the F&O market as “New Traders” in FY24. Unfortunately, 92.1% of these newcomers faced net losses, averaging around ₹46,000 per individual. In contrast, regular traders, making up 25% of the trading population, fared slightly better, though 88.7% still reported losses averaging ₹1,50,000.

Geographic Spread

Geographically, the analysis indicates that over 50% of F&O traders hail from four states: Maharashtra, Gujarat, Uttar Pradesh, and Rajasthan. Maharashtra alone accounted for 21.7% of traders, highlighting regional disparities in trading activity.

Trading Behavior and Persistence

Perhaps the most striking finding is the persistence of loss-making traders. An astounding 76.3% of these traders continued to engage in F&O trading despite suffering losses over two consecutive years. Out of 24.4 lakh investors who experienced losses in FY22 and FY23, 18.6 lakh persisted into the third year, but only 8.3% ultimately turned a profit.

Conclusion

The insights gleaned from SEBI’s analysis provide a sobering look at the state of equity derivatives trading in India. While the allure of profits can be enticing, the statistics reveal a landscape fraught with challenges, particularly for younger and less experienced traders. As we continue to explore the dynamics of the trading world, it’s crucial for participants to equip themselves with knowledge and sound risk management strategies.

SEBI has designed a standardized test for awarness of investors called SEBI Investor Certification Examination to gauge the financial literacy of individual investors. By ensuring investors are knowledgeable about various financial products, market mechanisms, and regulations, SEBI aims to promote a more secure and transparent investing environment.

Understanding these trends not only prepares traders for the realities of the market but also fosters a more resilient trading community.

I reckon something really special in this site.

You can definitely see your expertise within the work you write. The world hopes for even more passionate writers like you who are not afraid to mention how they believe. All the time follow your heart.

Heya i am for the first time here. I came across this board and I to find It truly helpful & it helped me out much. I hope to offer one thing again and aid others such as you helped me.

I have been surfing online more than three hours these days, yet I never found any interesting article like yours. It is lovely worth enough for me. In my view, if all site owners and bloggers made excellent content material as you did, the internet can be a lot more useful than ever before.

Have you ever considered publishing an e-book or guest authoring on other blogs? I have a blog based on the same subjects you discuss and would really like to have you share some stories/information. I know my viewers would appreciate your work. If you are even remotely interested, feel free to send me an e mail.

Thanks for your advice on this blog. A single thing I would like to say is that purchasing electronic products items in the Internet is certainly not new. The fact is, in the past 10 years alone, the market for online gadgets has grown a great deal. Today, you can find practically almost any electronic device and product on the Internet, from cameras in addition to camcorders to computer pieces and video gaming consoles.

It is really a great and useful piece of information. I am glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You’re amazing! Thanks!

I will right away snatch your rss feed as I can not to find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Please permit me recognise so that I may just subscribe. Thanks.

Hello, you used to write wonderful, but the last several posts have been kinda boring? I miss your tremendous writings. Past few posts are just a little out of track! come on!

The heart of your writing whilst appearing reasonable initially, did not work very well with me after some time. Somewhere throughout the sentences you managed to make me a believer unfortunately just for a short while. I nevertheless have a problem with your jumps in logic and you would do nicely to fill in all those gaps. In the event you can accomplish that, I will definitely be fascinated.

whoah this weblog is wonderful i like studying your articles. Stay up the great paintings! You know, lots of people are hunting round for this information, you could help them greatly.

I have observed that in the world of today, video games are definitely the latest phenomenon with kids of all ages. Occasionally it may be impossible to drag your family away from the games. If you want the very best of both worlds, there are plenty of educational video games for kids. Great post.

Hey! This is my first visit to your blog! We are a group of volunteers and starting a new project in a community in the same niche. Your blog provided us beneficial information to work on. You have done a wonderful job!

This design is wicked! You certainly know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Great job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!