Today marks a significant milestone for Bajaj Housing Finance Limited (BHFL) as it makes its debut on the stock market with .

The company’s initial public offering (IPO) has garnered considerable attention from investors and market analysts, resulting in a spectacular listing performance as you can see in below chart

In this article, I will delve into the details of BHFL’s bumper stock market listing, exploring the factors behind its success, as well as the implications for investors and the company.

Bajaj Housing Finance Limited (BHFL) is a prominent player in the Indian housing finance sector. As a subsidiary of Bajaj Finserv Limited, it operates with a strong legacy and a robust reputation. Specifically, the company specializes in providing loans for purchasing, constructing, or renovating residential properties. Its mission is to offer accessible and affordable financial solutions to individuals looking to realize their homeownership dreams.

This article will explore the key aspects of Bajaj Housing Finance, including its offerings, benefits, and impact on the housing finance landscape.

Bajaj Housing Finance: Company Background

Bajaj Housing Finance was established in 2008, expanding the financial services portfolio of Bajaj Finserv. Classified as an ‘Upper-Layer NBFC’ by the RBI pursuant to Scale Based Regulations, Bajaj Housing Finance Limited (BHFL) is a 100% subsidiary of Bajaj Finance Limited — one of the most diversified NBFCs in the Indian market, catering to more than 88.11 million customers across the country.

Headquartered in Pune, BHFL offers finance to individuals as well as corporate entities for the purchase and renovation of homes or commercial spaces. Additionally, it provides loans against property for business or personal needs, as well as working capital for business expansion purposes. Furthermore, BHFL offers finance to developers engaged in the construction of residential and commercial properties, as well as lease rental discounting to developers and high-net-worth individuals.

The Company is rated AAA/Stable for its long-term debt programme and A1+ for its short-term debt programme from CRISIL and India Ratings.

Key Offerings

Home Loans:

Bajaj Housing Finance provides home loans for a variety of purposes, including the purchase of a new home, constructing a new house, or renovating an existing property. These loans come with competitive interest rates and flexible repayment options, designed to cater to different financial profiles.

Balance Transfer Loans:

The company also caters to homeowners who wish to transfer their existing home loan from another lender to BHFL. This option is particularly beneficial for those seeking better interest rates or improved loan terms.

Top-Up Loans:

BHFL offers top-up loans to existing home loan customers who need additional funds for various purposes, such as home improvements or personal expenses. These loans are typically available at competitive interest rates and with flexible repayment terms.

Loan Against Property:

Bajaj Housing Finance also provides loans against property, allowing individuals to leverage their residential or commercial properties to obtain funding for business expansion, education, or other personal needs.

Key Points of Bajaj Housing Finance

Competitive Interest Rates:

BHFL offers attractive interest rates on its home loans, making it easier for borrowers to manage their monthly payments and reduce the overall cost of the loan.

Flexible Repayment Options:

Understanding that financial situations can vary, BHFL provides flexible repayment options including customizable EMI plans and prepayment facilities without penalties.

Quick and Easy Application Process:

The company emphasizes a streamlined and hassle-free application process. Customers can apply for loans online, with minimal documentation required, making the process efficient and user-friendly.

Customer-Centric Approach:

BHFL is committed to providing exceptional customer service. The company offers personalized loan solutions and dedicated support throughout the loan application and repayment process.

Wide Network:

With a widespread network of branches and digital platforms, BHFL ensures that customers have easy access to its services across various regions.

Impact on the Housing Finance Sector

Bajaj Housing Finance has made a significant impact on the housing finance sector in India. By offering a range of innovative and customer-centric products, the company has contributed to increased homeownership rates and improved access to housing finance. Moreover, its focus on digitalization and efficient service delivery has set new standards in the industry, influencing other players to enhance their offerings and operational practices.

Now Coming back to IPO detailsOverview of the IPO

Bajaj Housing Finance’s IPO has been highly anticipated, reflecting strong market confidence and investor interest. The company’s shares were offered to the public at a premium, and the initial response has been overwhelmingly positive. Notably, the IPO was structured to raise substantial capital, with shares being allocated to both institutional and retail investors. The successful listing is a testament to BHFL’s robust financial health and its strategic positioning in the housing finance sector.

Performance on Listing Day

On its listing day, Bajaj Housing Finance’s shares saw a remarkable performance. The stock opened significantly higher than the issue price, indicating strong demand and enthusiasm from the investor community. As the trading day progressed, BHFL’s share price continued to climb, reflecting positive investor sentiment and confidence in the company’s growth prospects.

Key Factors Behind the Bumper Listing

Strong Market Fundamentals:

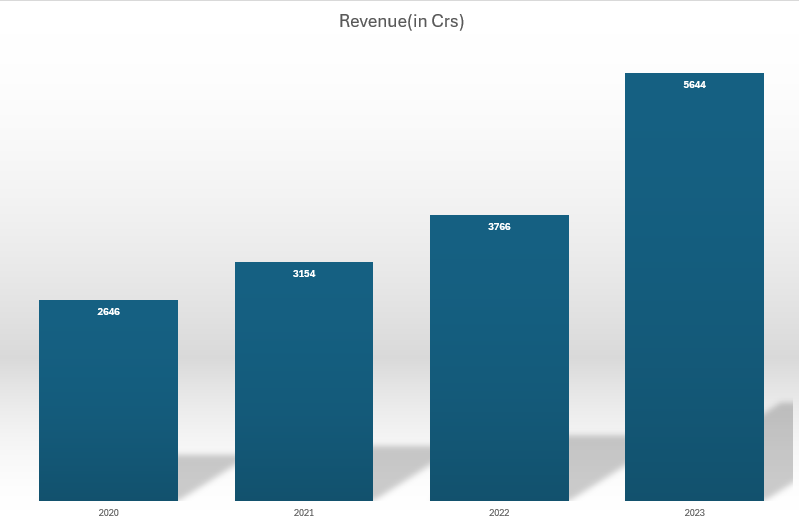

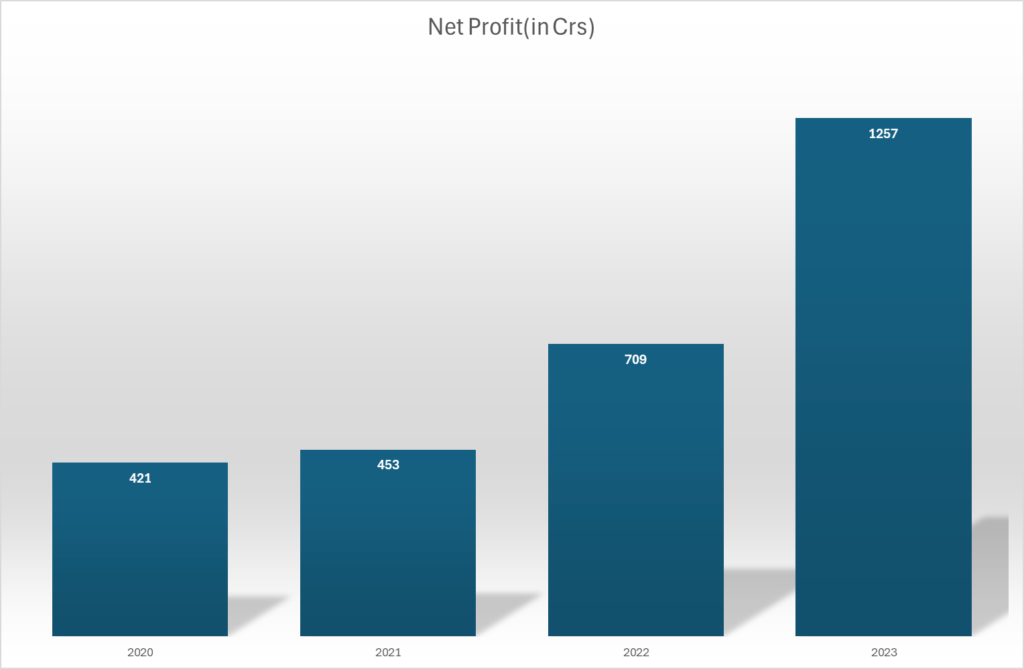

The housing finance sector in India has been experiencing growth, driven by increasing homeownership rates and supportive government policies. Consequently, BHFL’s solid financials and growth trajectory positioned it favorably in the market.

Reputation and Brand Value:

As a subsidiary of Bajaj Finserv, BHFL benefits from a well-established brand and a strong reputation in the financial services industry. This legacy of trust and reliability has played a crucial role in attracting investors.

Attractive Pricing:

The IPO was priced competitively, offering potential for significant returns on investment. The valuation and pricing strategy attracted a wide range of investors, contributing to the strong listing performance.

Market Sentiment:

Overall positive market sentiment towards the financial services sector and IPOs in general likely contributed to the enthusiastic response to BHFL’s shares. Investors are keen on participating in promising financial stocks, and BHFL’s IPO was no exception.

Growth Prospects:

Investors are optimistic about BHFL’s future growth prospects, given its comprehensive range of housing finance products and its strategic plans for expansion. The company’s focus on digitalization and customer-centric services has been well-received.

Implications for Investors and the Company

For Investors:

Short-Term Gains: Early investors who participated in the IPO are likely to benefit from the initial surge in share prices. The strong debut offers the potential for short-term gains.

Long-Term Potential: Investors who hold onto their shares may benefit from the company’s long-term growth. BHFL’s strategic initiatives and market position suggest promising future prospects.

For the Company:

Increased Capital: The successful IPO has provided BHFL with substantial capital, which can be used to fund expansion plans, enhance product offerings, and invest in technology and infrastructure.

Enhanced Visibility: Being listed on the stock exchange increases the company’s visibility and credibility. It also opens up opportunities for future capital raises and strategic partnerships.

Regulatory Compliance: The listing brings additional regulatory scrutiny, but it also enhances transparency and governance practices, which can further build investor trust.

Conclusion

Bajaj Housing Finance Limited’s bumper listing on the stock market is a significant achievement, reflecting strong investor confidence and a positive outlook for the company.

The impressive debut highlights the growing interest in the housing finance sector and the company’s strong market position.

As it continues to leverage its capital and strategic advantages, it is well-positioned to capitalize on the growth opportunities in the housing finance industry, thereby creating value for both investors and the broader market.

Bajaj Housing Finance Limited stands out as a key player in India’s housing finance market, providing a range of financial solutions designed to support individuals in achieving their homeownership goals. With its competitive interest rates, flexible repayment options, and customer-focused approach, BHFL continues to make a positive impact on the housing finance landscape. As the company evolves and adapts to changing market dynamics, it remains committed to delivering value and convenience to its customers, thus contributing to the growth and development of the housing sector in India.

I reckon something truly special in this internet site.

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Purdentix

Purdentix

Purdentix review

Purdentix reviews

Purdentix

Purdentix reviews

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

This site truly stands out as a great example of quality web design and performance.

It provides an excellent user experience from start to finish.

I love how user-friendly and intuitive everything feels.

The content is engaging and well-structured, keeping visitors interested.

I love how user-friendly and intuitive everything feels.

This site truly stands out as a great example of quality web design and performance.

The layout is visually appealing and very functional.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

It provides an excellent user experience from start to finish.

I love how user-friendly and intuitive everything feels.

This website is amazing, with a clean design and easy navigation.

This site truly stands out as a great example of quality web design and performance.

The content is well-organized and highly informative.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The layout is visually appealing and very functional.

The content is engaging and well-structured, keeping visitors interested.

The content is well-organized and highly informative.

The content is well-organized and highly informative.

The content is engaging and well-structured, keeping visitors interested.

The design and usability are top-notch, making everything flow smoothly.

This website is amazing, with a clean design and easy navigation.

It provides an excellent user experience from start to finish.

I’m really impressed by the speed and responsiveness.

AQUA SCULPT

It provides an excellent user experience from start to finish.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

I’m really impressed by the speed and responsiveness.

The layout is visually appealing and very functional.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

This website is amazing, with a clean design and easy navigation.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

The content is well-organized and highly informative.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

This website is amazing, with a clean design and easy navigation.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

I’m really impressed by the speed and responsiveness.

The content is well-organized and highly informative.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

ICE WATER HACK FOR WEIGHT LOSS

This site truly stands out as a great example of quality web design and performance.

I’m really impressed by the speed and responsiveness.

This site truly stands out as a great example of quality web design and performance.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

This website is amazing, with a clean design and easy navigation.

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

Every expert was once a beginner. Keep pushing forward, and one day, you’ll look back and see how far you’ve come. Progress is always happening, even when it doesn’t feel like it.

Nothing beats homemade pasta. The texture and flavor are just on another level compared to store-bought versions. Cooking from scratch is truly an art.

A good book isn’t just entertainment—it’s a portal to another world. The best stories stay with you long after you’ve turned the last page.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

I visited a lot of website but I conceive this one holds something extra in it in it

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Lift detox black

Hi there, everything is going nicely here and ofcourse

every one is sharing information, that’s in fact fine, keep up writing.

Check out my site … nordvpn coupons inspiresensation

I always emailed this web site post page to all my associates, for the reason that if like to read

it afterward my contacts will too.

my web site … nordvpn Coupons Inspiresensation

nordvpn coupon code 350fairfax

If you are going for best contents like me, just pay a visit this web page everyday because it presents

feature contents, thanks

Purdentix reviews

Fantastic site. Lots of useful info here. I¦m sending it to several buddies ans additionally sharing in delicious. And obviously, thank you in your effort!

Purdentix review

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Very great information can be found on website.

Every weekend i used to pay a visit this website,

because i want enjoyment, since this this site conations genuinely fastidious

funny information too.

Feel free to surf to my site eharmony special coupon code 2025

wonderful post, very informative. I wonder why the other experts of this sector don’t notice this. You should continue your writing. I’m confident, you’ve a huge readers’ base already!

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you! By the way, how could we communicate?

my homepage :: vpn

Very nice post. I simply stumbled upon your weblog and wished to say that I have really enjoyed browsing your blog posts. After all I’ll be subscribing for your rss feed and I’m hoping you write once more very soon!

Keep working ,splendid job!

I’ve recently started a web site, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work.

Loving the info on this internet site, you have done great job on the content.

I am continuously looking online for ideas that can benefit me. Thx!

You completed a few fine points there. I did a search on the subject matter and found mainly persons will agree with your blog.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

Very good written post. It will be supportive to anybody who utilizes it, including me. Keep up the good work – looking forward to more posts.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

I loved up to you’ll obtain performed proper here. The comic strip is tasteful, your authored subject matter stylish. nevertheless, you command get got an edginess over that you would like be delivering the following. unwell undoubtedly come more until now once more as precisely the same nearly very ceaselessly within case you protect this increase.

Excellent pieces. Keep posting such kind of info on your page.

Im really impressed by your blog.

Hello there, You’ve performed a fantastic job.

I will certainly digg it and in my opinion suggest to my friends.

I’m confident they will be benefited from this web site.

https://tinyurl.com/2ab5s5qz gamefly

What i don’t realize is in fact how you are no longer really a lot more well-favored than you might be now. You’re so intelligent. You understand therefore significantly when it comes to this subject, produced me personally believe it from numerous various angles. Its like women and men aren’t involved until it is one thing to do with Lady gaga! Your individual stuffs nice. At all times maintain it up!

I like this site because so much utile material on here : D.

I’ve recently started a web site, the info you provide on this website has helped me tremendously. Thanks for all of your time & work. “Character is much easier kept than recovered.” by Thomas Paine.

Howdy! I just want to give a huge thumbs up for the good data you could have right here on this post. I shall be coming again to your weblog for more soon.

I think that what you said was actually very reasonable. However, what about this?

suppose you were to create a killer headline? I ain’t suggesting your content is not good,

but suppose you added something that makes people want more?

I mean Bajaj Housing Finance IPO: Overhyped Success or good financials is kinda vanilla.

You should peek at Yahoo’s home page and note how they create news headlines to grab people interested.

You might add a video or a pic or two to get

people excited about everything’ve got to say.

Just my opinion, it could make your posts a little bit more interesting.

I’m impressed, I must say. Seldom do I encounter a blog that’s both educative and amusing, and without a doubt, you have hit the nail

on the head. The issue is something too few folks

are speaking intelligently about. I am very happy that I stumbled across this during my search for something relating to this.

This really answered my problem, thank you!

I would like to show my thanks to the writer just for rescuing me from this type of challenge. After surfing through the internet and meeting opinions which are not pleasant, I believed my life was gone. Existing without the presence of approaches to the difficulties you have sorted out as a result of your guide is a critical case, as well as the ones which could have in a negative way affected my entire career if I hadn’t noticed your web page. Your actual ability and kindness in controlling every item was precious. I don’t know what I would’ve done if I hadn’t encountered such a stuff like this. I can also now look forward to my future. Thank you very much for this skilled and results-oriented help. I won’t be reluctant to suggest your web blog to any individual who desires direction about this problem.

Hey there! I’ve been reading your site for some time now and finally got the bravery to go ahead and give you a shout out from Dallas Tx! Just wanted to mention keep up the excellent job!

I have been exploring for a bit for any high quality articles or blog posts on this kind of house . Exploring in Yahoo I at last stumbled upon this website. Reading this info So i am glad to convey that I have an incredibly good uncanny feeling I discovered exactly what I needed. I so much for sure will make certain to don¦t forget this site and provides it a look regularly.

Only wanna comment that you have a very nice site, I love the design it actually stands out.

You got a very wonderful website, Gladiola I detected it through yahoo.

With havin so much content do you ever run into any problems of plagorism or copyright

violation? My website has a lot of exclusive content I’ve either created

myself or outsourced but it looks like a lot of

it is popping it up all over the web without my agreement.

Do you know any solutions to help prevent content from being ripped off?

I’d genuinely appreciate it.

Also visit my homepage :: pink salt trick