Best Small-Cap Mutual Funds in 2025: Top Picks for High Growth

“Be greedy when others are fearful and be fearful when others are greedy.” – Warren Buffett.

Every finance enthusiast has heard this timeless quote, and it holds significant relevance in the current market scenario. Over the recent past, almost all major indices have corrected from their all-time highs and are still consolidating. While many investors may feel hesitant and prefer to stay on the sidelines, I believe this is precisely the moment to act—to invest, not wait.

Table of contents

Introduction

As investors seek high-growth opportunities in 2025, the best small-cap mutual funds continue to attract attention for their explosive potential. Historically, these funds have delivered impressive gains, often outperforming large-cap funds during bullish market phases. However, given their inherent volatility, selecting the right small-cap fund requires careful analysis. In this guide, we explore some of the best small-cap mutual funds in 2025 that could be game-changers.

What Are Small-Cap Mutual Funds?

Small-cap mutual funds primarily invest in companies with smaller market capitalizations, typically ranked below the top 250 companies in terms of market value. These funds are attractive for their higher growth potential, as smaller companies often have more room for expansion compared to well-established large-cap firms.

However, this high return potential comes with greater volatility and risk. Small-cap stocks are more sensitive to market fluctuations, economic changes, and liquidity constraints. While they can deliver substantial gains during bullish trends, they may also experience sharp declines during downturns.

For investors with a higher risk appetite and a long-term investment horizon, the best small-cap mutual funds in 2025 can be a rewarding addition to a diversified portfolio.

Market Context: Factors Influencing Small-Cap Funds in 2025

Several key factors will influence the performance of small-cap mutual funds in 2025:

- Economic Growth – A strong economy can boost small-cap companies, as they thrive in expansion phases.

- Interest Rates – Higher rates can increase borrowing costs for small businesses, potentially impacting profitability.

- Market Volatility – Small-cap stocks are more sensitive to market fluctuations, leading to sharper price swings.

- Inflation Trends – Rising inflation can increase input costs for small companies, affecting margins.

- Corporate Earnings – Strong earnings reports from small-cap firms can drive investor confidence.

- Liquidity Conditions – Small-cap stocks have lower trading volumes, making them more susceptible to price fluctuations.

- Global and Domestic Events – Geopolitical tensions and policy changes can impact market sentiment.

- Sector Performance – Certain small-cap sectors, like technology and consumer discretionary, may outperform depending on market trends.

While these factors provide insights, it’s crucial to remember that investment predictions are never guaranteed. Staying informed and aligning investments with your risk tolerance and goals is essential.

CRISIL Rating wise Top-Rated Small-Cap Mutual Funds in 2025

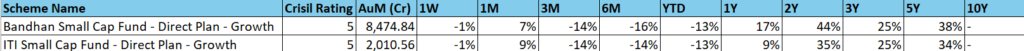

5-Star Rated Funds

- Bandhan Small Cap Fund

- ITI Small Cap Fund

These funds have demonstrated strong historical performance and effective risk management. Their returns across different timeframes highlight the importance of analyzing long-term trends, not just recent performance.

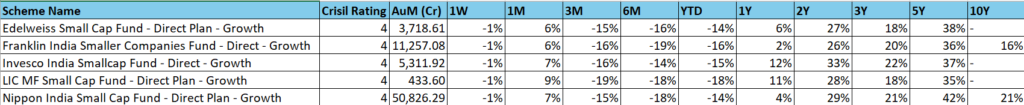

4-Star Rated Funds

- Edelweiss Small Cap Fund

- Franklin India Smaller Companies Fund

- Invesco Small Cap Fund

- LIC MF Small Cap Fund

- Nippon India Small Cap Fund

These funds have solid performance records with well-managed risk. Notably, Nippon India has a much larger AUM compared to LIC MF, showcasing strong investor confidence.

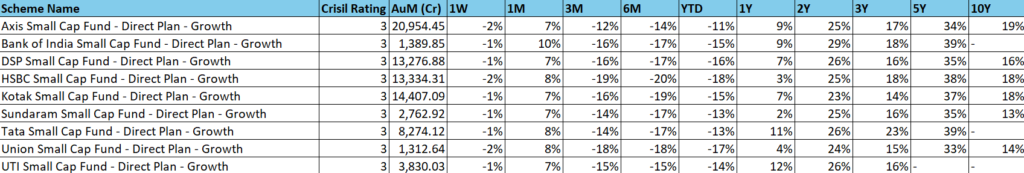

3-Star Rated Funds

- Axis Small Cap Fund

- Bank of India Small Cap Fund

- DSP Small Cap Fund

- HSBC Small Cap Fund

- Kotak Small Cap Fund

- Sundaram Small Cap Fund

- Tata Small Cap Fund

- Union Small Cap Fund

- UTI Small Cap Fund

These funds may have periods of underperformance or higher risk but still hold potential depending on market conditions.

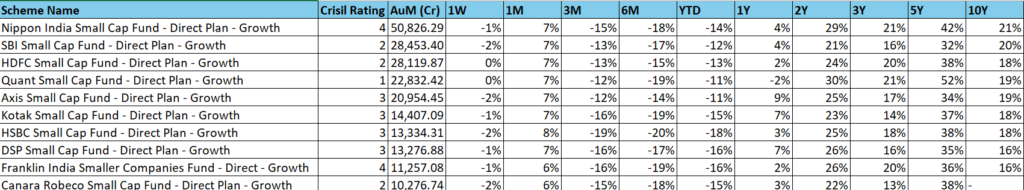

AUM wise Top-Rated Small-Cap Mutual Funds in 2025

Highest AUM Small-Cap Funds

- Nippon India Small Cap Fund – ₹50,826.29 Crore

- The largest AUM in the category, indicating strong investor trust. However, in the small-cap space, an extremely high AUM can pose challenges in efficiently managing investments in smaller stocks.

- SBI Small Cap Fund & HDFC Small Cap Fund – ~₹28,000 Crore

- Large AUMs with consistent long-term performance.

- Quant Small Cap Fund – ₹22,832.42 Crore

- Gaining popularity due to its recent high returns and dynamic investment strategy.

Mid-Size AUM Funds

- Axis, Kotak, HSBC, DSP Small Cap Funds – AUMs ranging between ₹13,000 to ₹20,000 Crore.

Smaller AUM Funds

- Franklin India Smaller Companies Fund & Canara Robeco Small Cap Fund – Around ₹10,000 Crore.

Funds with lower AUMs may have more flexibility in investing in small-cap stocks without impacting prices too much, but they may also face liquidity challenges.

Conclusion: Is Now the Right Time to Invest?

With market indices correcting and consolidating, many investors hesitate to enter the market. However, history suggests that the best small-cap mutual funds in 2025 often deliver exceptional returns after market downturns. While they come with higher volatility, disciplined investing with a long-term perspective can yield substantial rewards.

Investors should carefully evaluate funds based on performance history, risk management, AUM, and market conditions. Instead of waiting on the sidelines, now may be an opportune time to strategically allocate investments into high-potential small-cap funds.

As always, diversification and risk assessment are crucial. Consult with a financial advisor to ensure your investments align with your financial goals and risk tolerance.

Disclaimer

The content provided on this blog is for informational purposes only and should not be construed as financial, investment, or legal advice. All opinions expressed are solely those of the author and do not reflect the views of any organization or entity. The author and the blog do not assume any responsibility for any losses or damages arising from the use of the information provided. For More

Can I just say what a comfort to discover somebody that

genuinely knows what they are discussing on the web.

You definitely know how to bring a problem to light and make it important.

More people have to check this out and understand this side of the story.

I can’t believe you are not more popular because you surely have the gift.

Also visit my website … nordvpn coupons inspiresensation; ur.link,

Hmm it looks like your website ate my first comment (it was extremely long) so I guess I’ll just sum it

up what I submitted and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new

to the whole thing. Do you have any recommendations

for inexperienced blog writers? I’d certainly appreciate it.

My webpage :: nordvpn coupons inspiresensation (t.co)

350fairfax nordvpn cashback

Hi there! This post could not be written any better!

Looking through this post reminds me of my previous roommate!

He constantly kept talking about this. I am going to forward this article to him.

Fairly certain he will have a good read. I appreciate you for sharing!

Pretty element of content. I simply stumbled upon your website and in accession capital

to assert that I acquire actually enjoyed account your weblog posts.

Anyway I will be subscribing on your feeds and even I success you get entry to constantly rapidly.

My homepage; Vpn

Aviator demo APK download – fly with no fear

Step into BitStarz Casino today, get up to $500 or 5 BTC + 180 Free Spins, awarded Best Casino multiple times. Stay connected through official mirror.

Your favorite slots are available through casino mirror

continuously i used to read smaller posts that also clear

their motive, and that is also happening with this piece of writing which I am reading here.

gamefly 3 month free trial https://tinyurl.com/23mmjj8a

Quick aviator game review for beginners

Casino mirror means no more �access denied�

Лаки Джет: теперь на платформах 1WIN и Lucky Star — регистрация за 10 секунд!

🆓 Первый микрокредит бесплатно? Возможно!

Enjoy international gambling via casino mirror

Your casino profile remains safe on mirror access

Very nice post. I just stumbled upon your weblog and wanted to say that I’ve really enjoyed surfing around your blog posts.

After all I’ll be subscribing to your feed and I hope

you write again very soon! How does vpn work https://tinyurl.com/2c2rno87

You can’t miss Lucky Jet and tell your friends.

Aviator game download lets you start betting instantly.

Mirror servers provide safe access without legal concerns.

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

Hi! I understand this is sort of off-topic but I had to ask.

Does running a well-established blog such as yours require a lot

of work? I am brand new to writing a blog however I do write in my

journal daily. I’d like to start a blog so I can easily share my own experience and feelings online.

Please let me know if you have any kind of recommendations or tips for new aspiring bloggers.

Thankyou!

Hi, its pleasant post on the topic of media print, we

all know media is a fantastic source of data.

LeonBet ist mehr als nur ein Wettanbieter.